case study

Mortgage Broker saw a 5X in Leads while decreasing Cost-per-lead

Facing inconsistent and sporadic lead volumes, Aurora Financial turned to Qualified Leads to help grow their business.

Aurora Financial

Financial Services, New Zealand

“

Within three months, they were producing such good results that we actually engaged them on the KiwiSaver (retirement funds) and insurance side of the business [as well].

Digby Butcher

Head of Mortgages

Aurora Financial

Financial Services, New Zealand

“

Within three months, they were producing such good results that we actually engaged them on the KiwiSaver and insurance side of the business [as well].

Digby Butcher

Head of Mortgages

The Challenge

Aurora Financial faced significant challenges to business growth.

- Inconsistent lead volumes

While they were receiving leads, they came in sporadically, which made it difficult to maintain predictable revenue and plan for growth and hiring decisions. - Scaling budget and results

Cost per lead increased dramatically every time budgets were increased, making it unsustainable to continue at that rate.

Without a reliable and cost-effective system for generating leads, the business was unable to grow in a scalable way.

These issues created ongoing uncertainty and frustration, preventing Aurora from reaching it’s full potential.

The Solution

We implemented several targeted solutions to address Aurora Financial’s challenges.

- Complete rebuild of a broken Google Ads account

- Design and develop lead focused website Landing pages

- Creation of a lead form people actually fill out

First, we optimised Google Ads by building an account that improved cost-efficiency and lead consistency as well as its ability to scale in size.

We utilised high-converting landing pages and forms to capture leads more effectively and reduce drop-off rates.

With a dedicated account manager we ensured proactive campaign management and open communication lines between the sales and marketing teams allowed for better alignment and quicker adjustments.

The Results

5X Lead Volume

Business Growth

CPL Decreased

Trusted Partner

Within a year, Aurora Financial experienced a 5X increase in their number of leads, which fuelled business growth and enabled the expansion of their team.

The cost per lead significantly decreased, making their marketing efforts more cost-effective and scalable.

Improved communication between the sales and marketing teams created a strong feedback loop, enhancing overall performance.

In time, Aurora Financial has more than 8X their monthly digital marketing budget and lead volume.

Driven by the quality campaigns and a collaborative approach with Qualified Leads their business has flourished and grown even in a tough economy.

About Aurora Financial

Aurora Financial is built on the vision to provide New Zealand families with comprehensive financial advice tailored to their financial needs.

Aurora work with a variety of partners to provide mortgages across three major categories:

- First Home Buyers

- Refinance

- Investors

Partnering with growth minded businesses globally since 2021

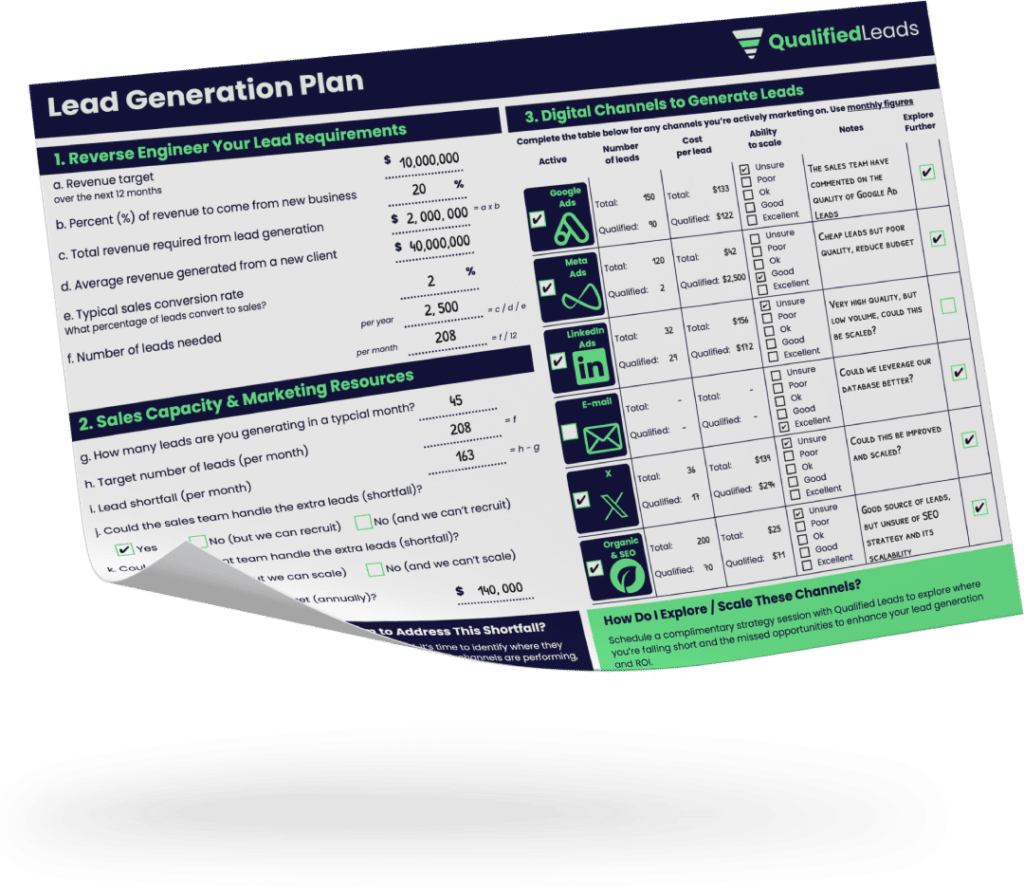

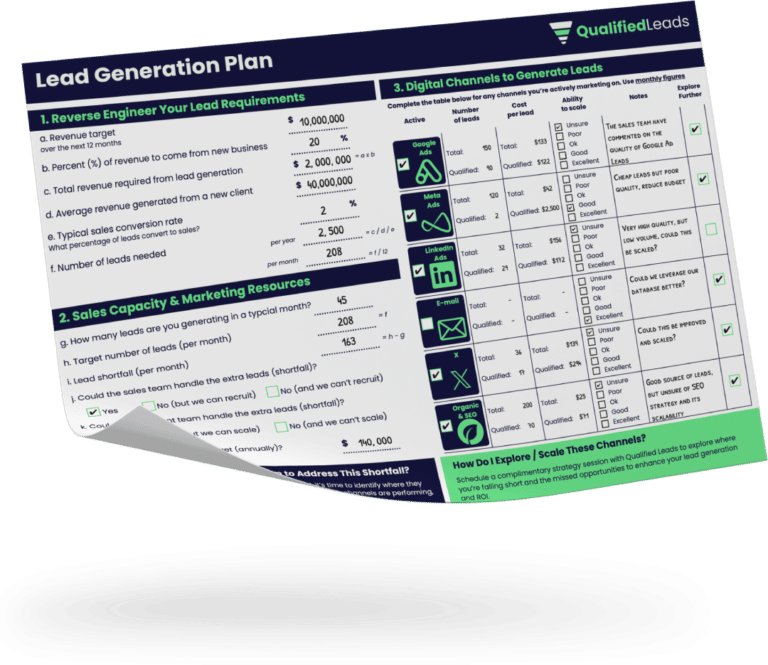

Start generating more leads with our free

Mortgage Leads Strategy

Download it today to:

- Grow mortgage broker leads

- Reach new first home, refinance, and investment leads

- Improve your sales close rates

- Help develop your lead generation engine

10,000+ mortgage leads generated with these strategies

The traditional digital marketing

agency model does not work…

Most digital marketing produces underwhelming results by failing to understand the relationship between sales and marketing. The marketing department works in isolation to the sales department, resulting in poor lead generation and a lack of strategy.

Why Trust Us

20 – 80

2-6

OUR APPROACH

We choose for our team members to handle less clients, allowing them to immerse themselves in that business.

Why Trust Us

Marketing Jargon

OUR APPROACH

Our reporting is tailored to each client to ensure we’re focused on the metrics, objectives and tangible results that matter to them.

Why Trust Us

Cookie-Cutter

Bespoke

OUR APPROACH

Every business has customers, products, objectives and resources that are unique to them – so we make sure its strategy is too.

Why Trust Us

Set & Forget

Constantly Iterating

OUR APPROACH

Campaign environments change daily. To keep up, we’re constantly iterating, seizing every opportunity to maximise the potential of your strategy.

Why Trust Us

Outsourced & Passed to Juniors

Dedicated Senior

Marketer

OUR APPROACH

We ensure that the person you speak with is the person developing and implementing your strategy, rather than a junior you’ve never met.

Why Trust Us

5-40%

0%

OUR APPROACH

We don’t take a percentage of ad spend as it results in a misalignment of incentives. When we advise you to scale, it’s because it’s right for you, not because we want to bill more.

A DIFFERENT APPROACH

We Are Not

a Digital Marketing Agency

If you’ve had a bad experience with a digital marketing agency before… you’re not alone. We have too. That is why Qualified Leads was created and why we set out to do things differently.

We pride ourselves on being digital marketing partners for our clients. This is reflected in our model which was purpose built to address the shortfalls of typical agencies and to ensure that everything we do is focused on getting results for our clients.

Want to get started now?

If you’re ready to grow, book a free consultation today and discover how our proven digital strategies can generate high-quality leads for your team!